Get the free wyoming form to get sales tax refunded

Get, Create, Make and Sign

How to edit wyoming form to get sales tax refunded online

How to fill out wyoming form to get

How to fill out Wyoming form 41 1:

Who needs Wyoming form 41 1:

Video instructions and help with filling out and completing wyoming form to get sales tax refunded

Instructions and Help about wyoming form 41 1 fillable

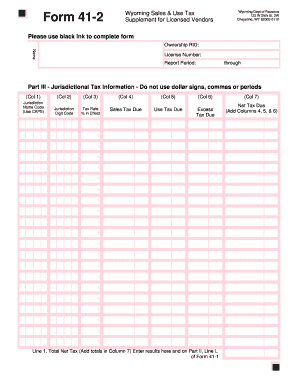

Welcome to the Wyoming Department of Revenue's tutorial for the forum 41 – 1 the intent of this video is to guide you through the process for completing the form that is commonly used by each monthly and quarterly filers in the state of Wyoming when completing the form your first step is to enter your total gross sales into line a these cells will represent both taxable and non-taxable sales however it should not include the collected taxes at this time line B is where you will subtract any exemptions in this case are any cells that you have made that were considered non-taxable according to Wyoming's statute 39 15 105 which lists those sales and leases that are exempt from sales tax please note that exemptions are construed narrowly exemptions are legislative acts of grace from the normal rule of at tax ability it is the responsibility of the purchaser to be certain that an exemption is available it is the responsibility of the vendor to be certain that the purchasers' exemption is documented by law vendors must retain copies of exemption certificates and direct pay permits of exempt transactions for audit purposes for a minimum of 3 years after you subtract line B from line a will enter the total into line C this is your total sales that are considered taxable in the state of Wyoming keep in mind that some businesses may never have any exempt sales, so they would just enter the total sales from line 8 into line C at this point you will drop to part 2 and complete this section before returning to line D this is where you will report the amount of tax collected for any reporting jurisdictions that you have made keep in mind you can find the jurisdiction name and digit codes in the vendors manual as well as online at the following web address in this case the business had sales of ten thousand six hundred and thirty-five dollars and eighty-seven cents that occurred in Natron County if it had tax rate of five percent which would equal five hundred and thirty-one dollars and seventy-nine cents in reportable tax collected this figure would be entered into column for sales tax due at this point when you add up the amount of tax who actually collected from your invoices or receipts it is possible that you may have actually over collected tax this can occur either by rounding up or possibly a mistake in the math during the sale if the over collection was not refunded to the customer then you are required to list the excess tax that you collected into column six in this case there was a dollar fourteen that was over collected please keep in mind that if you under collect tax then the whole amount owed is still due to the state of Wyoming column five is used to report any use tax owed by a vendor who has made purchases outside the state of Wyoming for their own use this does not refer to any items that the vendor buys with the intent to resell to their customers examples of this would be if you were to purchase a computer point-of-sale system cash...

Fill wy form 41 1 fillable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your wyoming form to get online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.